Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

The four-week feedback window is open as the EU pushes ahead on its sustainability agenda

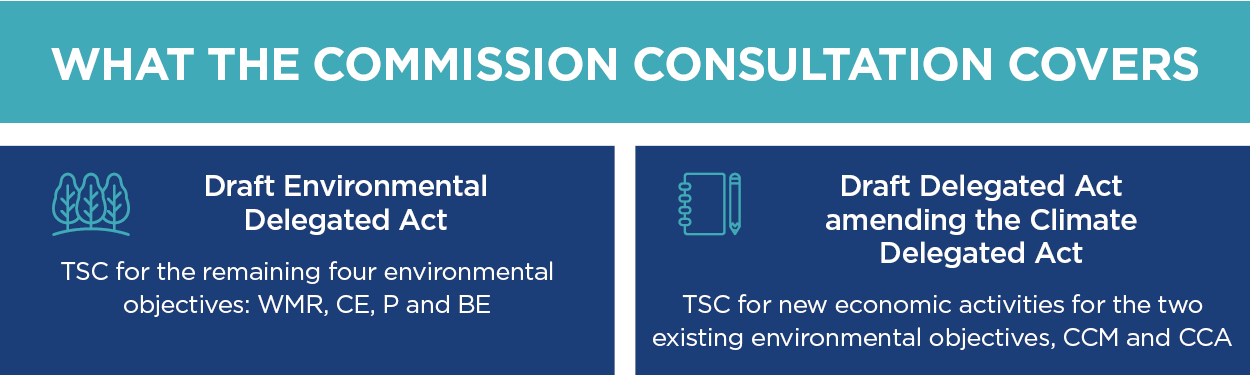

On 5 April 2023, the European Commission (the Commission) published for consultation two proposed delegated regulations intended to supplement the EU's Taxonomy Regulation (Taxonomy). These are the draft Environmental Delegated Act and another draft delegated act containing amendments to the existing Climate Delegated Act.

The much-anticipated draft Environmental Delegated Act sets out specific criteria (technical screening criteria or TSC) for economic activities that make a substantial contribution to one or more of the following environmental objectives:

1.The sustainable use and protection of water and marine resources (WMR);

2.The transition to a circular economy (CE);

3.Pollution prevention and control (P); and

4.The protection and restoration of biodiversity ecosystems (BE).

These, together with climate change mitigation (CCM) and climate change adaptation (CCA), make up the six objectives of the Taxonomy. (TSC for a set of economic activities considered to be most impactful for the two climate change objectives are already largely in place.)

The economic activities to which the newly proposed TSC relate cover the following sectors:

Not all sectors are equally relevant for each of the Taxonomy environmental objectives covered by the draft Delegated Act. For example, Annex II containing the TSC for the transition to a circular economy (lists 21 economic activities, whereas Annex IV on the protection and restoration of biodiversity ecosystems (BE) only covers two economic activities. According to the Commission, it prioritised "those economic activities and sectors that were identified as having the biggest potential to make a substantial contribution to one or more of the four environmental objectives and for which it was possible to develop or refine the recommended criteria without further delay." Of certain manufacturing activities and sectors such as agriculture, forestry and fishing, the Commission said further assessment and calibration of criteria are needed.

The draft Environmental Delegated Act also amends the Disclosures Delegated Act, widening the scope of disclosures required by the latter under Article 8 of the Taxonomy Regulation to reflect the new economic activities included in the former.

The draft Environmental Delegated Act (if agreed) will take effect on 1 January 2024. In the context of non-financial reporting under Article 8 of the Taxonomy Regulation, undertakings will be required to report on the four environmental objectives as follows:

For an explanation of the distinction between Taxonomy eligibility and alignment, see our earlier briefing.

There is no phasing-in of Taxonomy alignment disclosures for financial products under the EU's Sustainable Finance Disclosure Regulation (SFDR). Asset managers, insurers and other financial market participants will need to disclose on full Taxonomy alignment of products promoting environmental characteristics (Article 8, SFDR) or having an environmentally sustainable investment objective (Article 9, SFDR) from 1 January 2024.

In addition to the Environmental Delegated Act, the second proposed delegated regulation seeks to amend the Climate Delegated Act to add TSC for economic activities that are not yet covered. These relate to:

Unsurprisingly, the inclusion of aviation in the Taxonomy has been a point of contention. We have sought to cover the Commission's justifications for including the aviation sector in an earlier note.

In addition to covering new economic activities, the proposed delegated regulation also amends the TSC for certain existing activities (notably nuclear, transport, construction and renovation) in relation to the two Taxonomy climate objectives. Many amendments are mere clarifications, but some also tighten the TSC for "Do no significant harm" (DNSH) in relation to circular economy, water and marine resources and pollution.

The draft Climate Delegated Act (if approved) will also take effect from 1 January 2024. Undertakings will need to report on the newly introduced economic activities as part of their non-financial reporting using the same approach as for the Environmental Delegated Act (see above). There is, however, no phasing-in of the amendments to the existing economic activities which will need to be applied from 1 January 2024. SFDR disclosures again do not profit from a phasing-in, meaning that financial market participants will need to disclose on full Taxonomy alignment of both newly introduced and existing economic activities as of 1 January 2024.

Alongside the consultation, the Commission has unveiled its Taxonomy Navigator a website that introduces three new tools to help users navigate the otherwise expansive and complex Taxonomy. These tools are:

Taxonomy Regulation: A quick refresherThe Taxonomy Regulation establishes a classification system for companies, investors and policymakers to identify economic activities that can be regarded as environmentally sustainable or green. It is intended to increase transparency across the market and mitigate the risk of greenwashing. To this end, the Taxonomy Regulation lays down four qualifying conditions for economic activities to be deemed environmentally sustainable. Such activities must: 1.Substantially contribute to one or more of the six environmental objectives. 2.Do no significant harm to any of the other environmental objectives. 3.Comply with a series of minimum social safeguards. 4.Comply with the TSC for substantial contribution and DNSH set out by the Commission through delegated acts. We've covered the Taxonomy Regulation in more depth in an earlier briefing. Article 8 of the Regulation requires non-financial and financial undertakings to make public disclosures on how and to what extent their activities are associated with economic activities that qualify as environmentally sustainable. We've covered the Article 8 disclosure obligations in more detail in an earlier blog. Financial market participants including funds, asset managers and insurers need to disclose the degree of Taxonomy alignment for certain financial products subject to the SFDR, which are classified as promoting environmental characteristics (Article 8, SFDR) or having an environmentally sustainable investment objective (Article 9, SFDR). For more information on this, see our earlier bulletin. |

The short four-week consultation period for the two draft Delegated Acts closes on 3 May 2023. If the Commission adopts the Delegated Acts (with or without changes, having considered feedback on the consultation), and neither the European Parliament nor Council object to them, they will be published in the Official Journal of the EU and apply from 1 January 2024.

In separate but related news, on 18 April 2023, four environmental NGOs issued proceedings against the European Commission for its failure to remove natural gas (a type of fossil fuel) from the Taxonomy Regulation. The NGOs, consisting of ClientEarth, the WWF European Policy Office, Transport & Environment and BUND (Friends of the Earth Germany), allege that the classification of natural gas as "sustainable" is unlawful and is at odds with the Taxonomy Regulation itself, as well as other EU laws.

As usual, we'll be monitoring developments in this area. For more information, feel free to get in touch with the authors or your usual HSF contacts.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs